Table of Contents

For more than a decade, cryptocurrency has promised to fundamentally change how global payments work. In practice, however, that promise has remained largely unfulfilled. While crypto assets grew into a trillion-dollar market, everyday transactions continued to rely on traditional cards, bank transfers, and local payment systems.

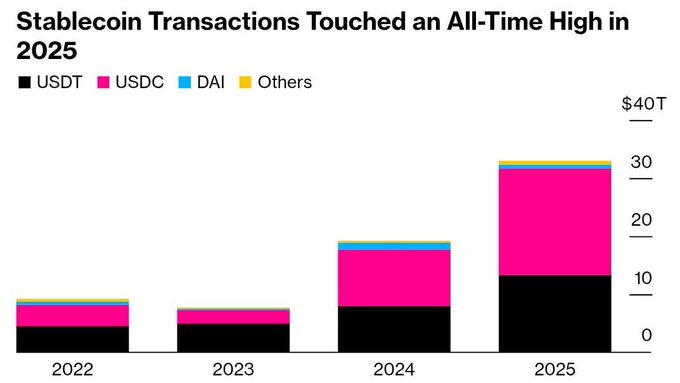

The common explanation was simple: blockchain transactions were viewed as too complex, unreliable, and hovering at the edge of mainstream commerce. However, as we approach 2026, the data tells a different story. In 2025 alone, stablecoins transactions reached a staggering $33 trillion according to reporting by Bloomberg, and are projected to hit $57 trillion by 2030.

The Rise of Stablecoins and Web3 Finance

According to data that you might find on platforms like CoinMarketCap, the sheer volume of stablecoin movement now exceeds the annual settlement activity of major card networks. Yet despite this massive liquidity, usage at physical and online checkouts has remained limited.

Sending digital currency from one wallet to another is easy, but the real challenge lies in scaling it into a Web3 system that lets you pay for anything, anywhere in the world. Whether users search for crypto or the alternative spelling krypto, the demand for seamless global payments is undeniable.

Why Crypto Can Move Money, But struggles with Payments

One of the clearest explanations of this gap comes from Jess Houlgrave, the CEO of WalletConnect, who has spent years working on payment infrastructure. Her observation is straightforward: blockchains are excellent at moving money cross-border (settlement), but commercial payments involve much more than just settlement.

A typical transaction involves a complex layer of:

- Authorization and confirmation

- Messaging between participants

- Refunds and reversals

- Compliance checks

- Dispute handling

Traditional networks like Visa or PayPal exist largely to manage these functions. They coordinate information and responsibilities between banks, merchants payment processors, and consumers. Conversely cryptocurrency systems were designed to move value directly; they were not originally designed to manage the surrounding processes that make payments reliable for businesses and regulators. As a result crypto payments often worked only in controlled environments or experiments.

The $33 Trillion Breakthrough: What Stablecoins Actually Fixed

Stablecoins addressed one major problem: price stability. Once a digital dollar reliably stayed close to one dollar it became usable for:

- Cross-border transfers

- Treasury operations

- B2B settlement

- Remittances

This explains the rapid growth in transaction volume. The data cited by Bloomberg shows that most of this activity is not speculative trading. It increasingly resembles real financial and settlement behavior, especially in regions with currency instability or inefficient banking systems.

However stablecoins alone did not solve the checkout experience. Merchants still faced fragmented wallets, different blockchains, varying standards, and unclear regulatory exposure. Consumers still had to make technical decisions they should never need to make during a payment.

Why Piggybacking on Cards and Google Pay Wasn’t Enough

Sure, crypto debit cards some compatible with Google Pay boosted usage but they anchored us to the past. By relying on traditional card rails, crypto remained trapped by legacy costs and limitations. It wasn’t a new payment system it was just a new funding source. To actually change commerce in 2026 and beyond a completely different approach was needed.

WalletConnect Pay: The New Standard for Web3 Commerce

Scaling payments is an art of invisible coordination. That is exactly what WalletConnect Pay was built to do. Think of it as the ultimate upgrade to the world’s financial plumbing. It handles the messy parts of payments that blockchains were never built for.

By standardizing how Web3 wallets and merchants interact it transforms clunky cryptocurrency transactions into a sleek 2-second experience.

- No new hardware for merchants.

- No confusing steps for users.

- Just scan approve and continue.

It is the seamless future of Web3 payments ready for the real world today.

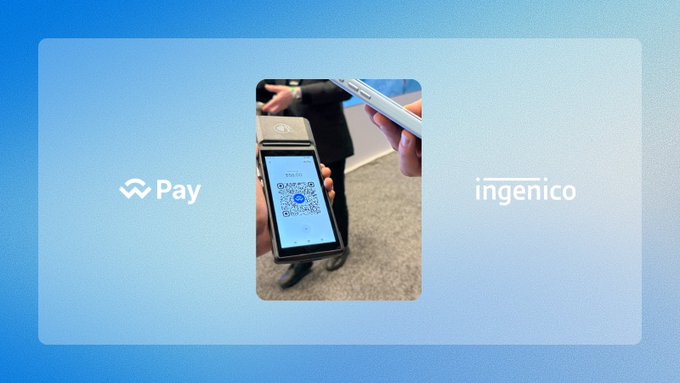

The Ingenico Integration

WalletConnect Pay has integrated with Ingenico unlocking stablecoins payments on 40 million terminals across 120+ countries. Suddenly crypto is available at your local grocery store gas station and hotel.

It works on existing Android terminals. Merchants don’t need new hardware they don’t have to hold digital assets and customers get the exact same checkout experience they already know. This is the moment cryptocurrency leaves the digital bubble and enters everyday commerce.

Why Merchants Will Actually Switch in 2026

Merchants don’t care about blockchain they care about fast settlement and ease of use. Traditional card networks often bleed businesses with 2–3% fees, agonizingly slow payouts and chargeback risks. WalletConnect Pay flips this by offering an upgrade that actually solves the problem for everyone.

WalletConnect Pay offers:

- Faster settlement times.

- Lower transaction costs compared to traditional processors.

- No exposure to market price volatility

- A checkout experience customers already understand.

These factors matter more to merchants than the underlying technology.

The $50 Million WCT Incentive

To supercharge adoption, the WalletConnect Network has proposed allocating 50 million WCT tokens in 2026. This sustainable, non-inflationary pool acts like Web3’s version of cashback: consumers get rewarded for making purchases, and wallets get paid for onboarding them. It is the ultimate economic kickstart for global crypto payments.

For the initial launch period:

- Consumers can earn up to 2% in WCT rewards.

- Eligibility covers transactions up to $100,000 per month.

- Available for both online and in-store purchases.

- Rewards are paid directly to the wallet used at checkout.

Winning on Utility, Not Just Ideology

To go mainstream, a payment system needs to be invisible and rewarding. WalletConnect Pay delivers exactly that by merging a standardized payment layer with usage based incentives. It eliminates friction for the merchant and creates value for the user. It creates the ultimate condition for scale: a system where cryptocurrency finally wins on practical terms.

What’s Next: Adapting to the Real World

The roadmap from here is focused on scale: pushing integration through global payment providers and making stablecoins the default choice at checkout. For a decade, the industry tried to force the real world to adapt to the blockchain. WalletConnect Pay finally adapts the blockchain to the real world.

The infrastructure is ready. One day, when you visit your nearest grocery store, you won’t have to ask, Do you accept Amex?” You can just ask, “Do you accept digital currency?” and the answer will be a definite yes.

Redefining Risk Management: Why the Outlook is Bullish

In the world of Web3 security is usually the biggest concern. WalletConnect Pay solves this by keeping assets non-custodial meaning users never hand over their private keys during a transaction. For merchants the risk of market volatility is completely eliminated through instant stablecoin settlement. By removing these two major barriers, the network isn’t just managing risk it is building the most secure foundation for the 2026 economy making the long-term growth potential undeniable.

Frequently Asked Questions (FAQ)

Q: How is this system different from standard apps like Google Pay? A: Unlike traditional apps that rely on banks, this new infrastructure uses decentralized networks. This cuts out the middleman, allowing for faster processing and lower fees without needing a credit card processor.

Q: Do I need a special app to spend digital assets? A: You likely won’t need a separate app. The goal is to integrate directly with the wallets you already use, making the checkout process as simple as scanning a QR code at the counter.

Q: Is it safe to use these assets for daily shopping? A: Yes. Because the system uses value-pegged assets (like digital dollars), it avoids the wild price swings usually associated with market trading. Your buying power remains consistent during the transaction.

Q: Where can I check the market data for these coins? A: You can view volume and market caps on major tracking platforms. As adoption grows, these sites are now listing real-world utility data alongside standard trading charts.

Q: Do stores need new machines to accept this? A: No. Through strategic partnerships, shops can use their current Android terminals. They receive the money in their local currency, so they don’t have to manage any complex digital wallets themselves.